A complete guide to earning the Southwest companion pass for 2023 and 2024.

How to Earn the Southwest Companion Pass

To earn the Southwest Airlines Companion Pass you must either: fly 100 qualifying one-way flights OR earn 135,000 Qualifying Points in one calendar year.

How to Get the Southwest Companion Pass With Credit Cards

Even if you don’t fly Southwest very much, you can easily earn most of the 135,000 points needed for a companion pass by earning a sign up bonus for 1 or 2 Southwest credit cards in 2023. You don’t need to use your 135,000 points for the companion pass so those points are available to you to book free award flights.

The sign up bonus for Southwest credit cards counts towards the points needed to earn Companion Pass status.

There are 5 versions of the Southwest credit card – 3 personal versions and 2 business versions.

For a limited time, all 3 versions of the personal Southwest credit card (our referral link) are offering a sign up bonus of 50,000 bonus points. You can earn 50,000 points after you spend $2,000 on purchases in the first 3 months from account opening and an additional 50,000 points after you spend $12,000 on purchases in the first 12 months from account opening.

(If you have a business, you can also apply and earn a signup bonus on one of the business versions).

Earning the Remaining Companion Pass Qualifying Points

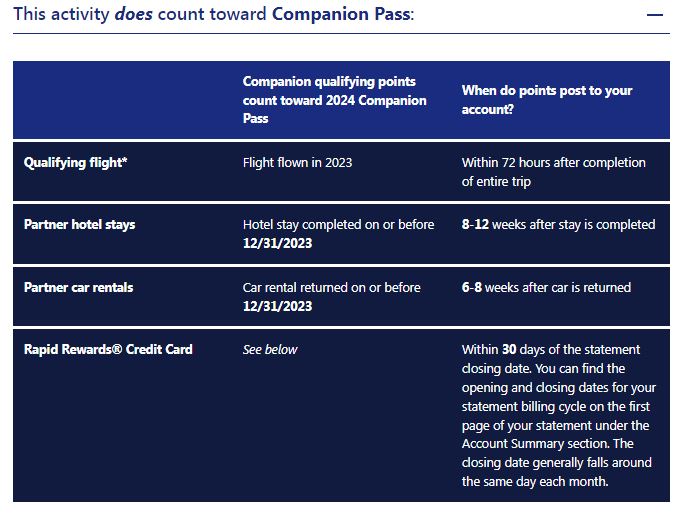

Other than credit cards, there are several ways to earn the remaining Companion Pass Qualifying Points needed including the following:

• Flying on Southwest revenue flights booked through Southwest Airlines

• Spending more money on your Southwest Rapid Rewards credit cards

• Base points earned from Rapid Rewards Partners. This includes online shopping.

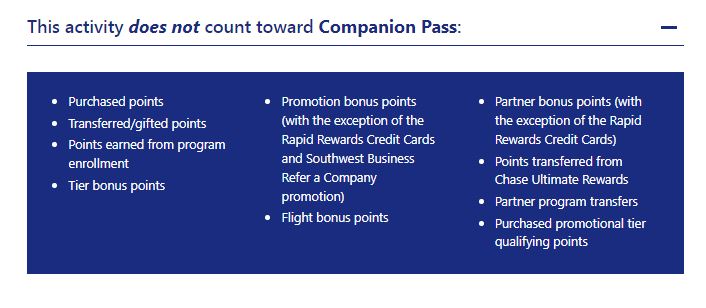

The following DO NOT COUNT for the companion pass according to Southwest:

“Purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards®, Valued Opinions, and Diners Club®; points earned from Rapid Rewards program enrollment; tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase).”

Transferring Chase Ultimate Rewards points to Southwest does not count toward the Southwest Companion Pass.

Best Time to Apply for Southwest Companion Pass

Unless you want to use the companion pass in 2023, the best option to maximize how long you have the companion pass for is to wait to apply late 2023/early 2024 (and complete your credit card spending in 2024) to earn the companion pass for most of 2024 and all of 2025.

You need to make sure not to complete the minimum spending requirements until early 2024. If you accidentally spend too much in 2023, you will earn the bonus in 2023 which you do not want. You want to earn sign up bonuses in early 2024 so that you can earn the companion pass in 2024.

If you time it right and earn the companion pass in January 2024, you can get the companion pass for almost two (2) full years.

If you need to use the companion pass in 2023, apply for a personal Southwest credit card ASAP and you will still have over 1.5 years to use the companion pass.

Is it possible to apply for all three Southwest card (Preferred, Plus and Business) to get 150,000 points and the companion pass?

I am not sure. I think getting all 3 Southwest cards is possible but probably not on the same day. You could maybe apply for 2 on one day and the other one 1-3 months later but before April. There is an annual fee on the cards so not sure if the extra annual fee on the 3rd card is worth it when you only need 6,000 more points. Also if you are interested in other Chase cards that 3rd card might make it harder to be approved for another Chase card you would want.

I know people rave about this program and I might look at it one day. Solid tip to qualify as early in the year as possible.

I already have a $69 southwest card. Can I apply for a premium and my husband apply for another card?

Yes you can do that.

The only issue is that Chase is now applying the 5/24 rule to Southwest cards so if you have been approved for more than 5 credit cards (from any bank) in the last 2 years you might not get approved.

On the Southwest disclosure it states that those with this same type of card are not eligible for the bonus. Are preferred and plus considered the same type of card?

No they are considered different cards.

If I apply for a credit card and am offered 50,000 pts will I be able to use them in exactly 3 months from now on a flight? Apply in late June, the 28th and use it when I need a flight say on September24th. It would be a few days short of the 3 month period. Will this work at all around those dates?

Linda,

You can use the points you earned whenever you want. You can use them as soon as they post into your Southwest Rapid Reward account or you can use them a year later. The points are yours.

additional comment, I realize I need to spend $2000 before I would receive the 50,000 pts. How long before those pts are into my account and I could use them? If I do not get an opportunity to use them in 2016 can I use them anytime in 2017? Thank you for any advice.

I am thinking about signing my wife up for a card. I secured the card on the 50,000 mile bonus program. Would the miles be credited to the one account so I could then be eligible for the “companion pass” program at 110,000 miles total?

No. You cannot combine points with your wife in one program. You would have to apply for another version of the Southwest card (there are 3 versions) to earn an additional 50,000 Southwest points. Also keep in mind that points have to be earned in the same year so if you got your bonus in 2016 you need to apply for another card and complete your minimum spending this year.

Thank you very much for your quick and through response.

Would applying for 2 southwest cards now in October be a good idea since I will lose most of 2016 for companion and only have 2017 left to use it… ?? Is it better to wait till January 2016 then apply ??? Please help me decide

It would not be a good idea to earn the companion pass this late in 2016 since you would only use it in 2016 and 2017. Ideally it would be best to earn the companion pass early 2017 and use it in 2017 and 2018.

However, you could still apply for 2 Southwest cards this year as long as you make sure you do not meet the minimum spending requirements until January. You want the Southwest points to be credited to your account in 2017.

If it were me I would probably apply in December but it would still be OK to apply now so long as you don’t spend enough on the cards to meet the bonus till January.

What is the best way to apply for 2 cards ? Apply for 2 same day or spread them out few weeks or months ?? I also have a business is it better to try 1 for business 1 regular.

Thanks for all the help

Hi Jerry,

Hard to say exactly. If you apply for 2 at the same time can you can meet the spending on both cards in 3 months? If you are at 4/24 cards then you should apply for 2 cards on the same day before Chase finds out you are at 5/24.

People get approved for 2 Chase cards on the same day but you might have to call the reconsideration line for the second card.

If it were me, I would probably apply for 2 cards on the same day if I got automatically approved for the first one and if I got denied for the second one I would just apply for it 3 months later.

As to which versions you should apply for it depends on your personal situation.

If you apply for 2 personal cards on the same day there will be only one pull on your credit report.

If you apply for a personal and business card on the same day you can argue that you need both a personal card and a business card. If you have a business they have different approval criteria than for a personal.

Either way I would make sure that you apply for 2 versions where you can find 50,000 bonus point sign up bonus rather than a lower one.

Hi! I am interested in the Plastiq program that you mention to pay rent. Can you explain to me how it works and any information you have about it? Have you used it before? Is it safe?

Thanks!

Hi Jen, Here is a post on Plastiq: https://thetravelsisters.com/review-plastiq-referral-program-pay-bills-mortgage-with-credit-card-fee-free/ We use it all the time to pay our mortgage and other bills.

I have referrals for the plus card with 50,000 points if anyone needs one. Send me an email billingskayla@gmail.com

I have referral links for both the Plus and Premium, 50K bonus. Email me at emilybhaha@gmail.com.

I have referrals available for the Southwest Premier and Plus Card and the bonus, if you meet the spending requirement ($2000 in 3 months), is an amazing 60,000 bonus points! We are trying to earn the companion pass so we can get in an extra trip or two before our daughter goes off to college. Please help by using the link to get a WHOPPING 60,000 bonus points after signing up and meeting the requirements. This will also be a huge jump start to earning your companion pass!! Thank you so much for considering using our link! Email me at ALFPalmer @ Yahoo .com and I will send, via email, the link for the card. Thank you!

Hello Travel Sisters:

I’m curious…. my wife has a Plus card, i have a Premier card is there any way for us to get a companion pass since neither of us would be able to apply for both personal cards?

How long have you had your current Southwest cards? If it has been longer than 24 months since receiving your sign up bonus and you are under Chase 5/24 you could cancel the card and reapply for that card again.

The other option is if you have any kind of business or are thinking of starting one (even as a sole proprietor using your SSN) you or your wife can apply for one business and one personal.

I just called SOUTHWEST rep and the rep stated that I cannot add two Southwest bonuses to the same account. only one credit card bonus per account (even if I apply for two cards on the same day and am accepted) Is that true?

No that is not true. You can get a credit card bonus per each version of the Southwest Card. The points are given by Chase anyway so not sure if the Southwest rep would be that knowledgeable about this.

Once I have the companion pass, if I cancel one of the cards will that affect my companion pass status in any way?

No that will not affect your companion pass status. However, I recommend keeping the card open at least 11 months as banks don’t like it if you close a credit card immediately after receiving a sign up bonus.

Anyone have any referral links for STW plus or premier at 50k? Everything I find is 40k or below, and not interested.

thanks!

My family travels free always on Southwest using the Southwest Companion Pass (on my third one) and Southwest points. Love the SW Companion Pass!

hey i have referrals for the plus and premier card. I am trying to get companion status. Please email me at mjones3@neomed.edu if interested. Thanks!

patti, thx for the heads-up. does the 5/24 also apply to the biz version as well to potentially get approved? TIA

If I apply for a credit card now but don’t spend enough money until the beginning of 2019 to get the sign-up bonus, will the points count for 2019? Or is it safer to wait until 2019 to sign up for the credit card?

It is fine to sign up for the card in 2018 as long as the points are posted in 2019. If you think you might accidentally overspend or maybe you have an authorized user that could charge more than you expect then it might be safer to apply late Dec 2018 or early Jan 2019. If you apply now, you can also wait to activate the card till 2019 so you don’t risk spending too much in 2018.

Hello! Thanks for your awesome blog! Do you mind clarifying a bit? My comp pass expires end of 2018. I’m 3700 points away from renewing it. I’m confused cuz your blog & others say to wait to spend in Jan 2019 to earn the pass for 2 years, but SWA says points reset on Jan 1st. If I wait to spend in Jan, won’t I lose my 106,300pts & the pass?

Since I’m so close, I’m not applying for new cards.

Hi Jane, Can you clarify what year you earned your 106,300 pts? They key is to earn all 110,000 points in the same year and you will get the pass for that year and the next year. The reason why everyone says to wait till early next year is because if you earn the pass early in a year you get almost 2 years whereas if you earn the pass late in the year you get only about a year.

I got a business card with the $60k bonus offer (w/ $3k spend) and accidentally spent $3004 for the statement ending on December 28. Can I delay the points to January by making a return or only paying off $2999?

Oh no! Paying off $2999 will not work. Returning something could work so it is definitely worth trying. Some banks let you change your statement closing date so maybe see if Chase will let you push it to January.

My husband and I both have regular SW credit cards. We have the companion pass for 2019 as we got in on that 2019 deal with just getting a credit card (one of us hadn’t had one) We want the 2020-21 companion pass. Can one of us just simply add a plus or premier card to get that? We understand we need to do it in January 2020, receive points and spend money early in year. We do not work (retired) so can’t get the business card.

You would need to earn 110,000 points in 2020 to get a companion pass. One card would not give you enough miles to earn the pass unless Southwest does a special promotion. You could sign up for one personal card when it is offering 60,000 points and earn the remaining 50,000 another way.

Although you are retired, a business card could still be an option. You don’t need to have any income yet and can open a business card as a sole proprietor. People get business cards for businesses such as selling things on ebay or amazon, freelance writing or other services.

I am planning ahead and want to earn the SW Companion pass for 2020 and 2021- when do you think is the best time to apply?

Hi Guy, You would need to make sure you earn all your 110,000 points in 2020 to get the companion pass. Some people will open 1 or 2 cards late in 2019 and time it to meet the minimum spending and earn the bonus early 2020 but there is a risk something could go wrong and you accidentally meet your minimum spending in 2019 and earn the bonus in 2019. Personally unless I had a SW flight in January and needed the pass right away, I would apply for 1 or 2 cards mid to late December (since it will take some time to get the card in the mail), activate it on January 1 and spend the money early January.

Just to be clear after reading all the comments, it has changed and you cannot get the bonus on the priorty, plus or premiere in the same year correct? You can only get one of these every 24 months?

Yes that is correct.

Hello Sisters

I am 26,000 short of CP this year.

If I take a trip this month Nov. 2019 will the points post in time for 2020 CP? I can reach the mark but the point is when and how do they do the point application in the year of completed travel or the year the points post?